AccSys Learning Centre

How To Handle Tariff-Related Layoff Final Payments Properly

by Doug Dickie | Jun 12, 2025

Nobody likes to lay off staff. However, doing so properly can ease the discomfort felt by all parties concerned, and helps the employee receive the support they may need as smoothly and quickly as...

Always Verify Billers’ Bank Changes

by Doug Dickie | May 12, 2025

We wanted to share a quick best practice to help protect your business from one of the most common types of payment fraud: changes to banking details that haven’t been verified. Fraudsters are...

Adagio DocStore: Your Virtual Filing Cabinet

by Doug Dickie | Apr 7, 2025

DocStore provides a virtual filing cabinet for all of your documents such as invoices, purchase orders and check advices that are associated with accounting transactions. It transforms the audit...

Pay Statement and Tax Slip Best Practices

by Doug Dickie | Mar 17, 2025

Pay statements (or pay stubs) and T4 tax slips ensure more than just compliance with legislation. They provide transparency and strengthen trust between employers and employees. Here’s what to...

Five Tips for Hosting Your First Zoom Meeting

by Doug Dickie | Feb 17, 2025

These days, professionals are working from home in greater numbers than ever before. As entire companies shift to telecommuting, web conferences are playing an increasingly important role in the...

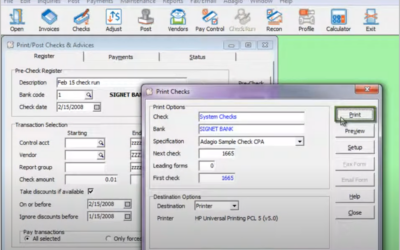

Processing Checks is a Breeze with Adagio Accounts Payable System Check Processing

by Doug Dickie | Jan 6, 2025

If you enter a larger volume of vendor invoices, you can run a function to search for invoices to pay to ensure that none are missed. To start system check processing, access Print Post Checks and...

Get A 2024 Year End Payroll Procedure Checklist

by Doug Dickie | Dec 9, 2024

Year end is always a busy time in the payroll department. To help things run more smoothly, the National Payroll Institute has created this payroll year end checklist of action items. We hope you...

Six Rules For Making a Good Remote Work Policy

by Doug Dickie | Nov 19, 2024

The business world is constantly changing. The latest major change is the dramatic rise of remote work. Remote work brings with it a variety of potential problems, which must be dealt with properly....

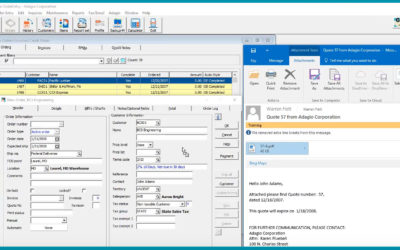

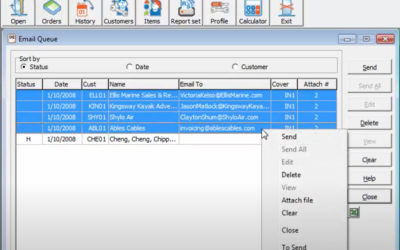

Emailing Forms Directly From Adagio

by Doug Dickie | Nov 1, 2024

The fastest and most efficient way to send forms to your customers and vendors is by email. It is simple to generate these emails, to send the forms, and to include any associated attachments. To...

T4 Reporting as a Successor Employer

by Doug Dickie | Sep 17, 2024

Firstly, what is a “successor employer”? A successor employer is a new employer that continues its predecessor’s business in substantially unchanged form and hires employees of the...

Why Your Business Needs an Intrusion Detection System

by Doug Dickie | Aug 13, 2024

An Intrusion Detection System (IDS) is a key pillar in a company’s cybersecurity strategy. It serves as the organization’s vigilant watchdog, continuously monitoring network traffic and...

How to Minimize Check Voiding in Adagio Accounts Payable

by Doug Dickie | Jul 18, 2024

If your company regularly pays a large number of Vendor invoices with a single payment and would like to avoid wasting check forms with ‘VOID’, you can do this by creating a check spec...